Portfolio beta calculator

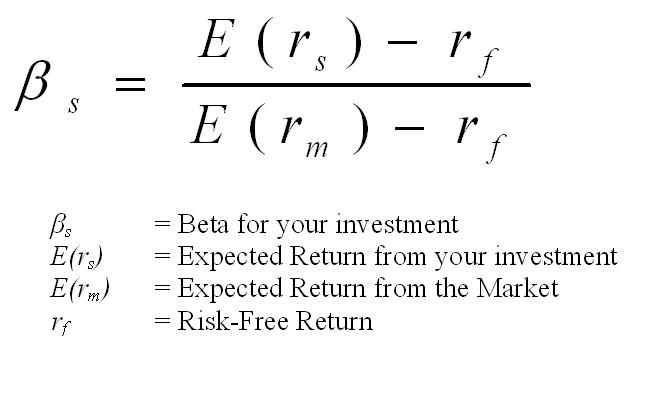

The calculator below provides key investment portfolio risk metrics. An investor is looking to calculate the beta of Apple as compared to the SPDR SP 500 ETF Trust.

An Amazing Online Grid Generator For Photoshop And Illustrator Work Like Magic And Adds A Grid To Your Document W Graphic Design Tools Interactive Design Grid

From the calculation above portfolio A has a greater than 100 beta.

. Portfolio beta equals the sum of products of individual investment weights. Especially it will take a benchmark or volatility in count. Add up the value number of shares x share price of each stock you own and your entire portfolio.

How Do You Calculate the Beta of a Portfolio. At first we only consider the values of the last three years about 750 days of trading and a formula in Excel to calculate beta. Beta is a standard.

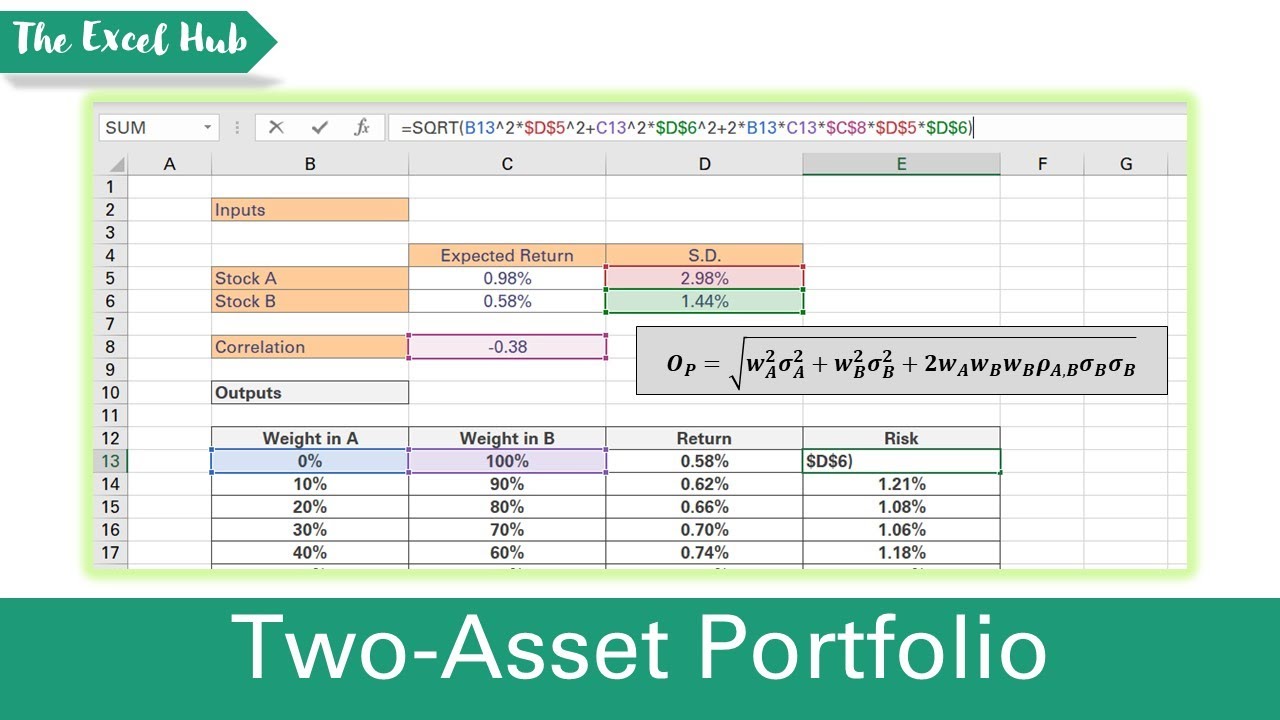

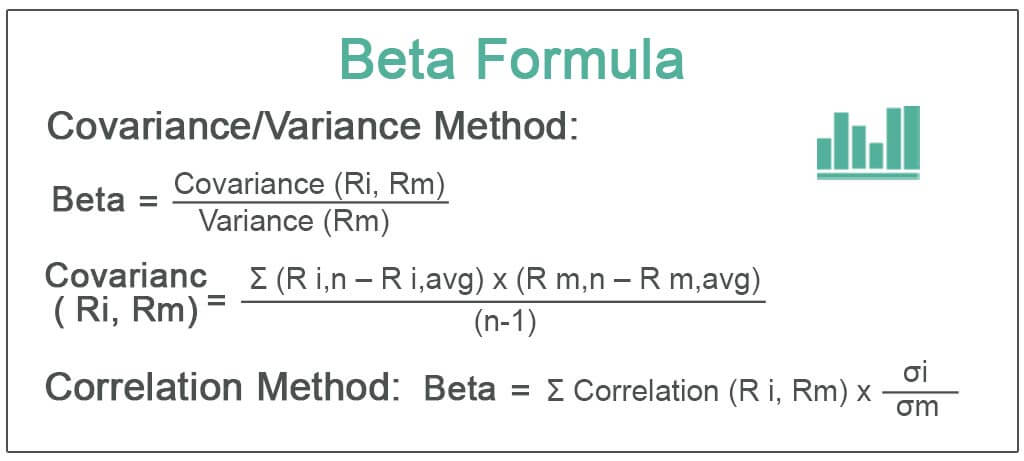

To calculate the beta of a security or portfolio we divide covariance between the return of security and market return by the variance of the market return. BETA FORMULA COVAR D1. Once you have the covariance.

Beta can be calculated using above beta formula by following below steps-. From a computational perspective a simple way to compute an ex-ante beta is to compute the risk of every asset in the portfolio to X. Calculation of Beta by above Beta Formula-.

If you are investing in a companys stock then the beta allows you to understand if the price of that security has been more or less volatile than the market itself and. Calculate the total value of each stock in the portfolio by multiplying the number of shares that you own of the stock by the price of its shares. As a tip when calculating portfolio Beta if you have a beta that is way outside a normal range of 0-4.

Where r s Return. Specify StockETFCryptos quantities to instantly view Portfolio Beta for timeframes calculated using recent financial data. Based on recent five-year data the correlation between AAPL and SPY.

This portfolio beta template will help you calculate the weighted average beta of all of the stocks in your investment portfolio. Portfolio Beta Template. According to our calculator we now have a negative portfolio beta.

You can calculate portfolio beta. Portfolio Beta Excel Calculation Example. Where Re Stock Return.

Based on these values determine how much you have of each stock as a. Portfolio calculator is another important thing that you may need to run a company. Beta β as a measure.

First its important to understand that beta is measured on a scale comparing an individual investment to a benchmark index. You can determine the beta of your portfolio by multiplying the percentage of the portfolio of each individual stock by the stocks beta and then adding the sum of the stocks. Online Portfolio Beta Calculator.

Thats why the beta lets you. Risk contributions volatility beta value at risk VaR maximum drawdown correlation matrix and intra-portfolio. In contrast if the market return decrease by 10 the return of the portfolio of beta 100 would also decrease by 10.

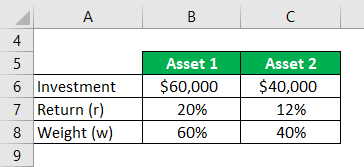

Suppose you know of five stocks and their individual stock betas and portfolio weights as follows. Portfolio beta is an important input in calculation of Treynors measure of a portfolio. Rm Market Return.

How To Calculate Beta With Pictures Wikihow

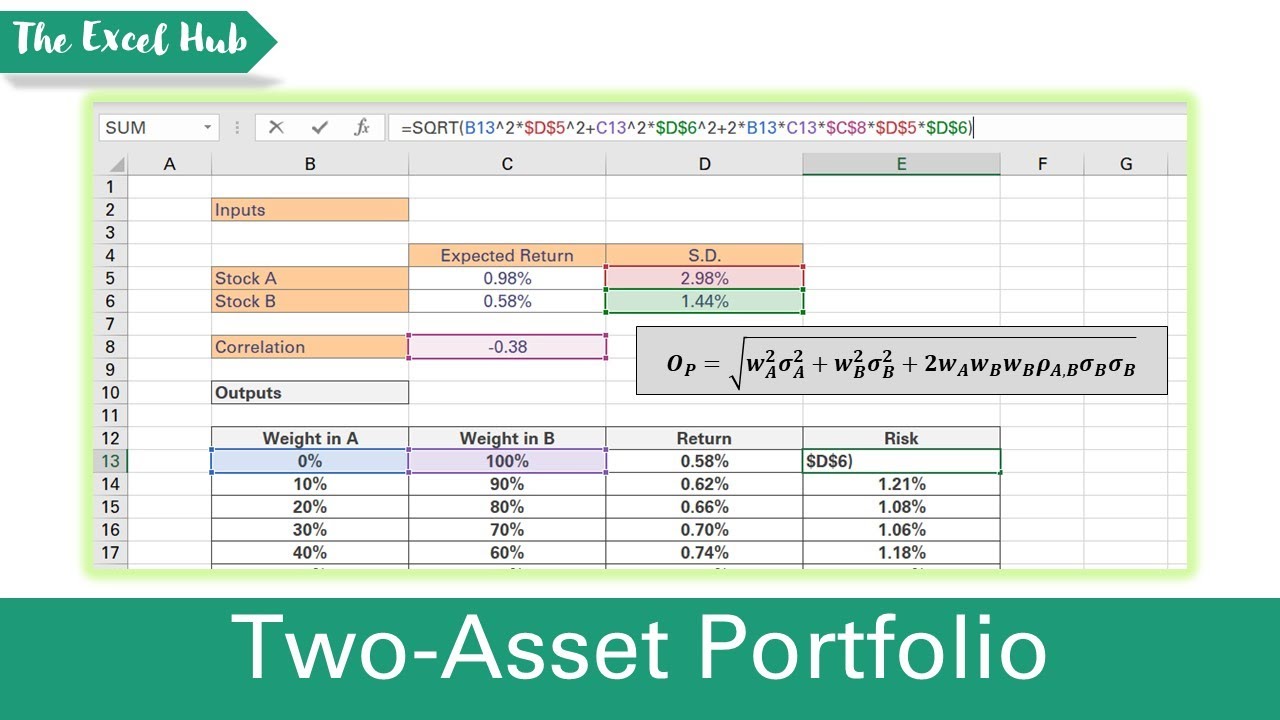

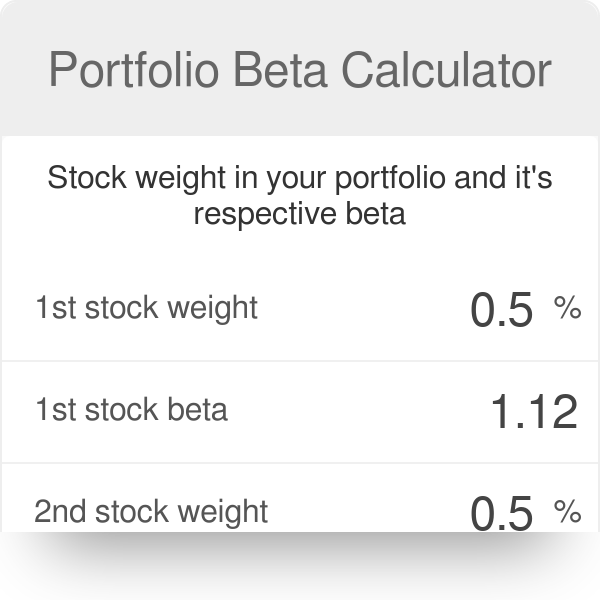

Calculate The Beta Of A Portfolio In Excel The Excel Hub Youtube

Beta Calculation Made Easy Invest Safely Com

How To Calculate The Beta Of A Portfolio Youtube

Portfolio Beta Calculator

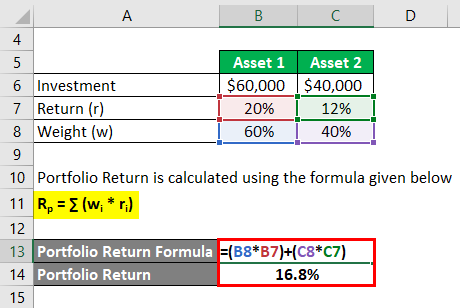

Portfolio Return Formula Calculator Examples With Excel Template

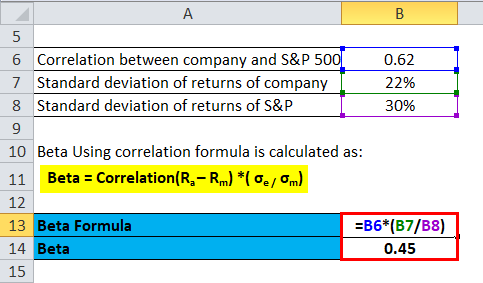

Beta Formula Calculator For Beta Formula With Excel Template

Explanation Of Alpha And Beta Investing Financial Education Investment Portfolio

Portfolio Beta Calculator

Beta Calculator Mathcracker Com

Calculate The Beta Of A Portfolio In Excel The Excel Hub Youtube

Calculating Beta In Excel Portfolio Math For The Average Investor

Portfolio Return Formula Calculate The Return Of Total Portfolio Example

Beta Formula Top 3 Methods Step By Step Examples To Calculate Beta

Calculate Stock Beta With Excel

Portfolio Return Formula Calculator Examples With Excel Template

Calculating Expected Portfolio Returns And Portfolio Variances Youtube